The Pros and Cons of Community Group Buying for Wine in China

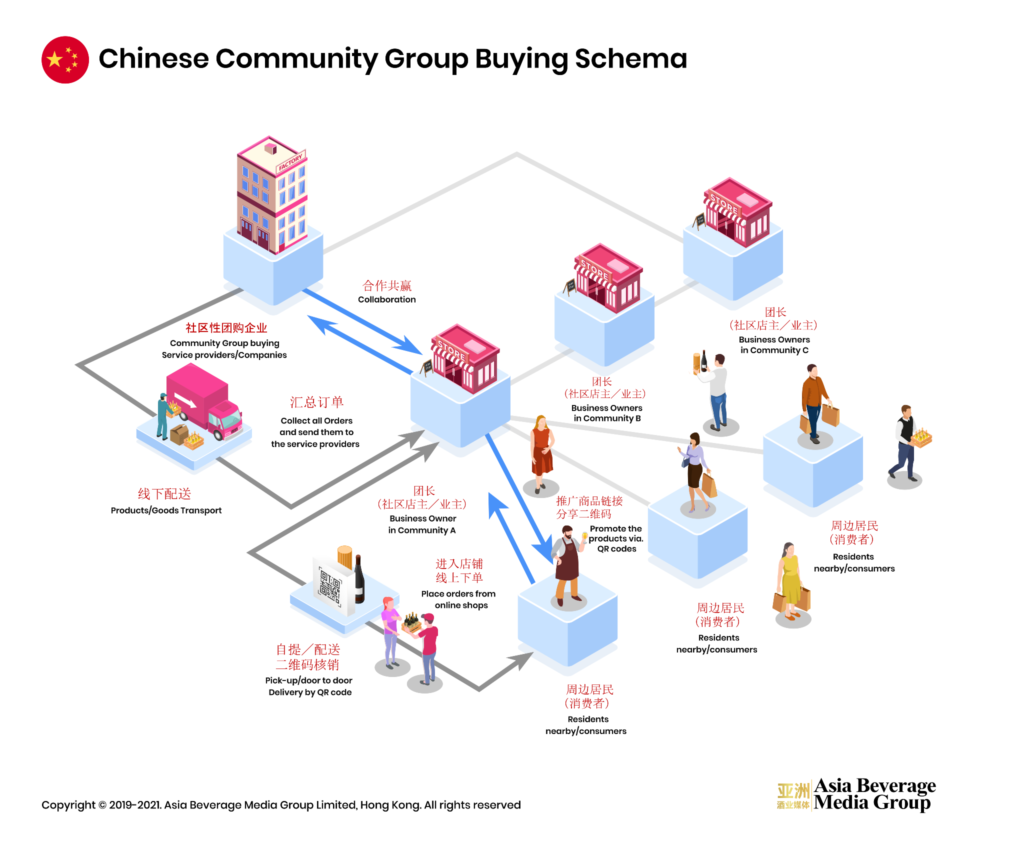

In 2020, the hottest buzzword in the Chinese retail market was community group buying. As the name implies, community group buying operates within a real, offline community for which a single household or local store manager serves as a centralized distribution point for goods purchased by the members of the community. This community leader typically uses WeChat groups, WeChat applets, and mobile apps as platforms for collecting orders from each member of the community, as well as for arranging the bulk purchases and deliveries.

At the beginning of last year, when many regions and districts in China fell into lockdown as a result of the pandemic, community group buying grew more popular and eventually became the primary channel through which residents of these areas purchased their everyday essentials and fresh foods. In the latter half of the year, China’s major e-commerce players rushed onto the scene with their own specialty community group buying platforms.

Since wine enjoys such an intimate relationship with the fresh food consumer market, the wine industry was quickly pulled into the fray as well. Many of the largest community group buying platforms now offer the sale of wine products, and China’s domestic wine leader, Great Wall Wine, announced in March of 2020 its plans to recruit community partners to insert into its own retail sales network, thereby closing the loop with its customers and further refining and securing its operating network.

Due to the specific attributes of the product, the community group buying of wine presents some unique areas of note:

High Channel Adaptability

To be sure, wine is a highly suitable product for community group buying platforms. Similar to the market for fresh foods, wine consumers display low brand loyalty, high channel adherence, and relatively frequent repeat purchases.

Due to the convenience of the community group buying method, shopping impulses can be quickly transformed into completed purchases, minimizing the time spent by consumers in the decision-making process and thereby increasing sales efficiency.

With so many different types of wine available, the majority of Chinese consumers have not yet formed fixed purchasing habits as far as particular brands and products, but instead rely on recommendations from friends and family or promotions from trusted channels and outlets. However, because wine has a high drinkability and a lower alcohol content, consumers are more likely to form a habit for wine in general, at which point their repeat purchases will be relatively frequent.

Over the past year, as the social activities that traditionally serve as important sales platforms for wine have been cancelled, wine sellers have shifted toward package deals and the delivery of wine and food pairings as a way to extend their reach into consumers’ homes during lockdowns. Due to the convenience of the community group buying method, shopping impulses can be quickly transformed into completed purchases, minimizing the time spent by consumers in the decision-making process and thereby increasing sales efficiency.

Rapid Spread and Fragmentation, Lower Customer Acquisition Costs

Currently, many sellers are feeling the strain of increasingly difficult e-commerce operations. Online platforms have an enormous scope, and many sellers are faced with intense competition there; meanwhile, the costs of growth on these platforms by gaining additional site traffic continue to increase by the day.

Looking at Alibaba’s customer acquisition costs, the cost of each new customer added in 2017 was 279 yuan, while the cost of each new customer in 2019 was 536 yuan – a 92% increase. Jingdong faced an even more extreme rise: their cost of acquiring a new customer in 2016 was only 142 yuan, but had jumped all the way to 758 yuan for 2019.

Because products reach consumers directly with community group buying, operating costs can be spread out with higher efficiency.

Today, with increased reliance on private traffic and the fast pace with which community group buying spreads and fragments, customer acquisition costs for many online platforms have dropped to the low double digits. Meanwhile, because products reach consumers directly with community group buying, operating costs can be spread out with higher efficiency. Some wine sellers with good market foresight have been able to penetrate the community group buying channels throughout the past year, already enjoying greatly increased business.

Facilitating Brand Propagation through Effective Communication

In addition to its high drinkability, wine also connects with consumers due to its broad and diverse product selection. The different varieties, production regions, traditions, vintages, fermentation techniques, and more all have an impact on the wine drinking experience, and make it possible for consumers to be individual and unique in their selections.

In community group buying, the community group leader takes on the role of a customer service representative, acting and responding according to customer demands. In addition, because many of the products purchased by the community group are daily essential items, the group leader forms a high level of familiarity and trust with the consumers in their community; the group leader becomes a highly effective communication channel that can be utilized to spread digitalized promotional content.

Through the community group leader, wine brands can convey their value and quality, wine knowledge within the community grows, and consumers become more familiar with all of the wines they purchase.

Through the community group leader, wine brands can convey their value and quality, wine knowledge within the community grows, and consumers become more familiar with all of the wines they purchase. All of these factors help establish consumer purchasing habits and increase customer loyalty.

While there are clearly many advantages for wine sales achieved through community group buying, it is still a relatively new kind of business model.

As such, it also presents wine sellers with many challenges:

High Sensitivity to Price

Those participating in community group buying tend to be extremely attuned to product pricing. In today’s market, there is no shortage of wines available at the 19.90 and 29.90 yuan price points, with examples found on online platforms such as Jingdong’s Jingxi, Meituan’s Meituan Select, Pinduoduo’s Buy More Food, and DiDi’s Chengxin Select. Some wine is offered as low as 9.90 yuan per bottle, and this type of pricing can lead consumers to wonder about the quality of the product. Furthermore, consumers tend to switch between these low-price platforms rather frequently, making it impossible to build a healthy and dependable consumer base by selling them.

Increased Pricing Complexity

The rapid rise of community group purchasing has been a major attack on an already segmented retail market. At the current stage, in order to gain market share, e-commerce giants have subsidized community group buying on the scale of 10 billion yuan, in some cases dropping consumer prices down to match seller costs.

This subsidization destroys the former pricing systems of the brand, and leads to chaos in the market. For this reason, some in the industry have already begun to resist community group buying platforms; however, considering its current state of growth, such resistance will likely have little impact in the end. The complexity of pricing management across retail networks will undoubtedly increase for sellers as community group buying continues to spread.

Platform Monopolization of End-User Resources and Data

Many sellers are attracted to the Chinese retail market because of its staggering order of magnitude. With such a large population, the absolute growth brought by increased sales in the Chinese market can be extraordinary. The major platforms’ subsidizing power in support of community group buying was initially motivated by their desire for increased market share, and the resulting market monopolization by these platforms has become worrisome.

Even more worrisome, however, is their use of big data to achieve and hold the monopoly. It has been shown time and time again that these platforms sometimes offer greatly decreased prices to new customers, and much higher prices to existing customers. The long-term impacts of such actions on the circulation of goods remains to be seen.

Community group buying is still very much in the wild west frontier stage of its development as a business model, and as such it has also attracted the attention of national regulation agencies.

Community group buying is still very much in the wild west frontier stage of its development as a business model, and as such it has also attracted the attention of national regulation agencies. Last December, the People’s Daily published a series of articles imploring China’s e-commerce giants to bear more social responsibility. The articles generated much public discussion about the health of the industry’s recent development, and encouraged follow-up actions to implement more effective regulatory measures with the hope that the industry would fall back into a more orderly state of competition.

As you can see, China’s retail market is changing at a breathtaking rate – please contact us to learn even more about the impact on the current state and future prospects of the Chinese wine market.